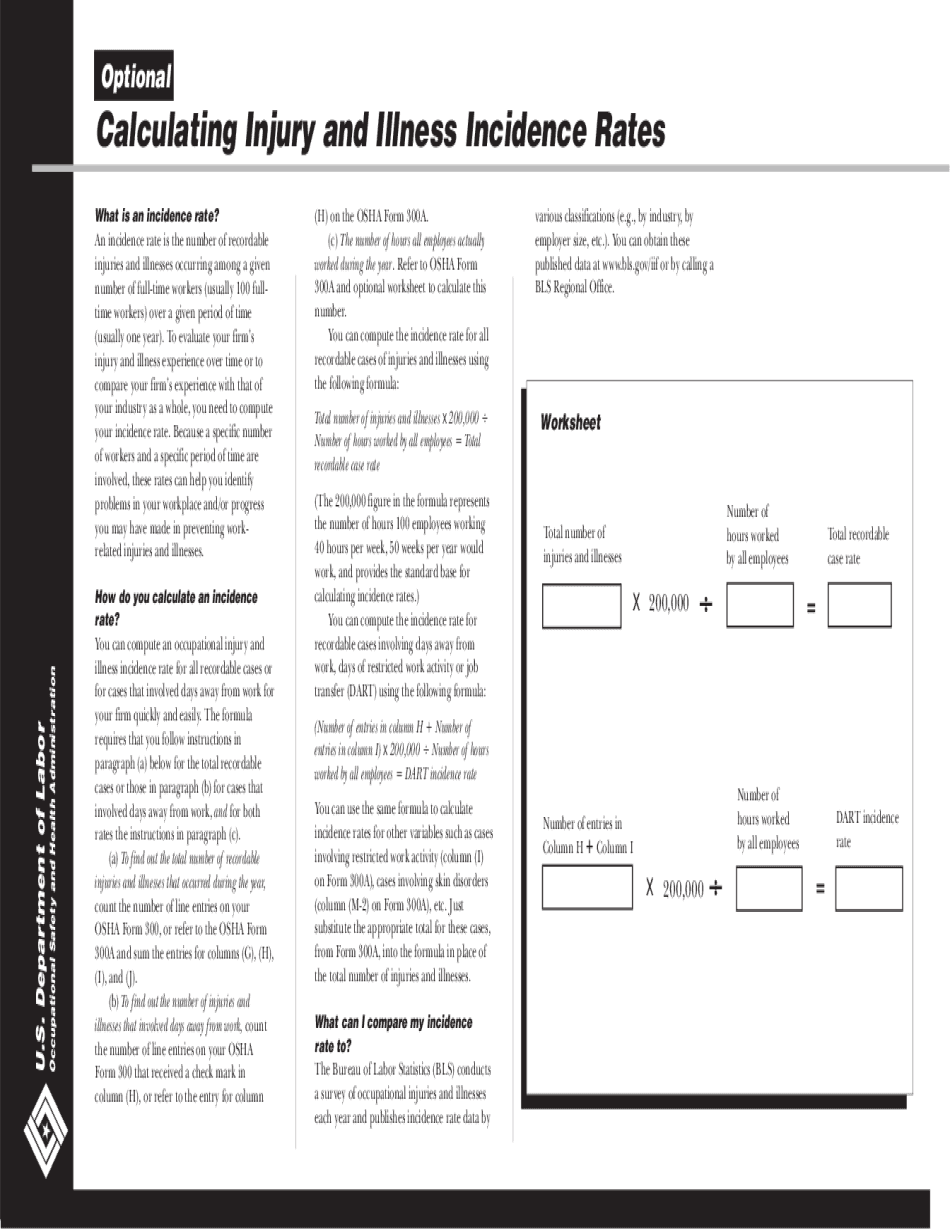

Record-keeping requirement is employers to look at you when you go on their website. You can look up other employers that qualify to be required to be reporting and keeping their records to compare themselves in the marketplace to other employees or other employers. That was based off an executive order that President Obama put in place 13 707, and they based that off of a behavioral science study that shows this is the thinking that if you have this information out available, let's say just for example Walmart, Target can look at Walmart's information compare themselves to it. If they see hey, we have more workplace injuries than Walmart does, we need to step it up, we need to get better. So there is a general principle behind it that's positive, and that was the reasoning for doing so. Now, whether or not that will be positive when it's implemented, we shall see. However, whether or not you're happy about it, we shall see. But that was the overarching general idea process behind what the new record-keeping requirement will eventually unfold. So ,we're talking about record-keeping, what are the records they have to be kept? These are the big three, not talking about Lebron, Bosh, and Wade, we're talking about the form 300, 300 a, and 301. Now, depending on the size of your company, maybe you're familiar with all these forms, maybe you're only familiar with the top form, the form 300, and I'm going to talk a little bit later about which employers have to deal with which specific forms. But generally, these are the three record-keeping forms that have to be taken into account when you're talking about these new updating record-keeping requirements. So, just as a general principle, the 300 form is the log that...

Award-winning PDF software

Osha electronic reporting login Form: What You Should Know

TRANSFER Tax (excluded from reappraisal): IF THE GRANTER: Serves this application, (a) The undersigned hereby grants the grantee the right and authority of a mortgagee to assign one or more real property in this county, without the payment of any mortgage and as security, a deed of gift of a real property or portion of a real property, in exchange for the payment of this fee equal to .00 for each 100,000.00 of fair market value of the real properties that will be transferred under this agreement. IF THE GRANTER: Cannot serve this application, (a) The undersigned hereby assigns the property described above in this application, without the payment of a mortgage or security deposit, in exchange for this fee equal to .00 for each 100,000.00 of fair market value of the real properties that will be transferred under this agreement. IF THE GRANTER: Does not serve this application, (b) The grantee has been granted the right and authority of a mortgagee to transfer one or more real property in this county, without the payment of a mortgage and as security, a deed of gift of a real property or portion of a real property, in exchange for the payment of this fee equal to .00 for each 100,000.00 of fair market value of the real properties. (d) The grantee has been assigned and granted all title privileges to the real property described above in this application in exchange for the payment of this fee equal to .00 for each 100,000.00 of fair market value of the real properties. (e) The grantee has a personal and legal right and authority: to be free from all obligations, liens, security interests, encumbrances, mortgages, etc. That would otherwise encumber or affect this property. (f) The undersigned grantee has been granted the right and authority of a mortgagee to lease this property subject to the terms and conditions of this agreement. The undersigned grant is a duly licensed mortgagee that has not received a waiver notice from any State or Federal agencies.

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Osha 300 Log, steer clear of blunders along with furnish it in a timely manner:

How to complete any Osha 300 Log online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Osha 300 Log by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Osha 300 Log from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Osha electronic reporting login